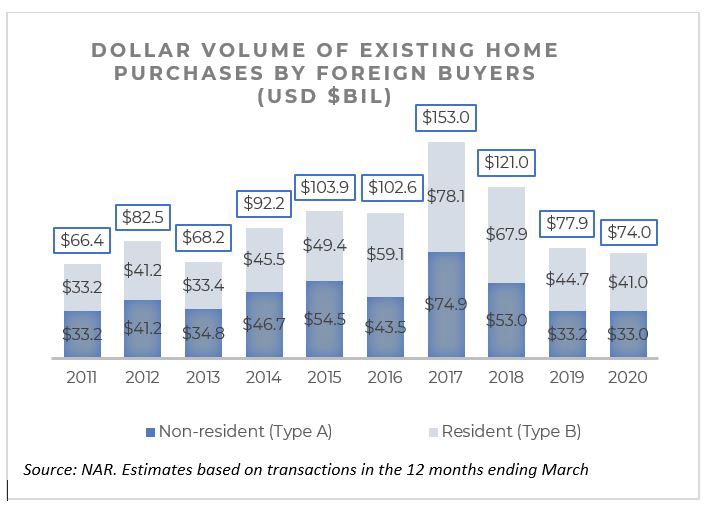

Foreign buyers continued to pull back for the second year, purchasing $74 billion of U.S. existing home sales from April 2019–March 2020, a 5% decrease from the prior 12-month period, according to the National Association of REALTORS®. Foreign buyer purchases made up 4% of the $1.7 trillion existing-home sales.

International clients (non-U.S. citizens) who already resided in the United States as recent immigrants or who held visas that allowed them to live in the U.S. for work, business, education purposes (Type B) purchased $41 billion of U.S. existing-home sales, or 61% of the dollar volume of purchases. Foreign buyers who lived abroad (Type A) purchased $33 billion of existing home sales, accounting for 39% of the dollar volume.

Foreign buyer purchases declined as trade tensions escalated between the U.S. and China in 2019, resulting in weaker global economic growth and weaker currencies relative to the dollar — conditions that lower the purchasing power of foreign buyers. The decline in foreign buyer purchases in the 2019 and 2020 NAR reports comes amid a marked drop in foreign direct investment in newly acquired businesses, trade, and persons granted permanent legal residence and non-immigrant visas for businesses, travel, and education since about 2017 and in the wake of regulatory measures of China’s government to closely monitor dollar outflows from China since 2016. The low inventory of homes for sale also constrained the home buying of international and domestic buyers alike. The sustained appreciation in home prices and the weaker currencies relative to the dollar also made a home purchase less affordable for foreign buyers living abroad (Type A).

The U.S. travel bans to control the spread of coronavirus to the United States that took effect from February may also have impacted some transactions that were due to close, but that impact does not appear to be significant based on the monthly REALTORS® Confidence Index survey.

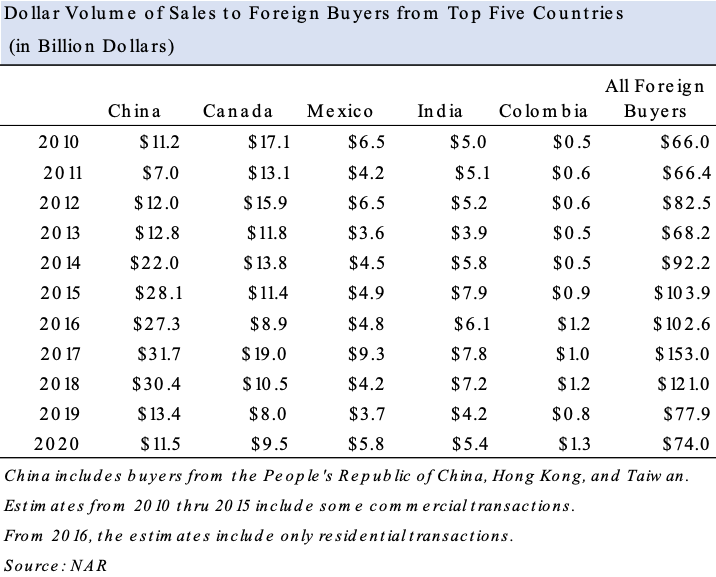

China remains the #1 buyer of U.S. residential real estate despite a steep decline since 2018

Purchases of existing homes of Chinese foreign buyers have declined from $30.4 billion during the 12 months ended March 2018 to just $11.5 billion during the 12 months ended March 2020, but they remain as the largest buyer of residential property, slightly ahead of Canadian buyers who purchased $9.5 billion of existing homes. Mexican buyers purchased $5.8 billion, followed by Asian Indian buyers, at $5.4 Bn. Colombia rounded out the top 5, purchasing $1.3 billion. Colombia replaced the United Kingdom as the 5th largest country of origin of foreign buyers.

For the reference period of April 2019-March 2020, the majority of Canadian (74%) and Colombian buyers (61%) lived abroad (Type A) while only a minority of Asian Indian (11%) and Mexican (31%) buyers lived abroad. Thirty percent of Chinese buyers lived abroad, a decline from 41% during the prior 12-month period.

Florida remains the #1 destination of foreign buyers

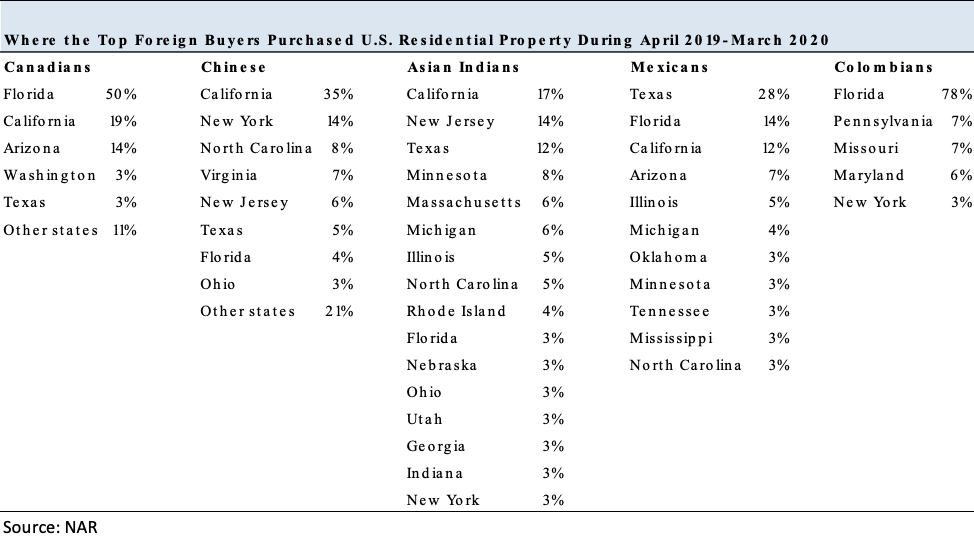

Florida remained the major destination, attracting 22% of foreign buyers. Florida’s foreign buyers mostly come from Latin America (35%) and Canada (29%). Florida was the top destination among Canadian and Colombian buyers.

California was the destination of 15% of foreign buyers. Fifty-four percent of California’s foreign buyers came from Asia/Oceania. It was the top destination among Chinese and Asian Indian buyers.

Texas attracted 9% of foreign buyers. Forty-two percent of Texas’ buyers came from Latin America/Caribbean. Texas was the top destination among Mexican buyers.

New York accounted for 5% of foreign buyers, with 51% coming from Asia/Oceania. It was a major destination among Chinese, Asian Indian, and Colombian buyers.

New Jersey accounted for 4% of all buyers. Fifty percent of New Jersey’s buyers came from Asian/Oceania. New Jersey was a major destination among Chinese buyers.

Other major destinations were North Carolina, Arizona, Minnesota, Georgia, Illinois, and Virginia. Arizona had been one of the top five destinations in past years but was not in the top 5 list this year. It was a major destination among Canadian buyers.

Higher median purchase price among foreign buyers reflects location choices

The median existing-home sales price among foreign buyers was $314,600, 15% more than the median price of $274,600 of all existing-homes sold in the U.S. during the April 2019–March 2020. The price difference reflects the choice of location and type of properties desired by foreign buyers. Chinese buyers had the highest median purchase price, at $449,500, with nearly half of Chinese buyers purchasing property in California and New York.

Thirty-nine percent of foreign buyer transactions were all-cash sales, with a higher percentage among non-resident foreign buyers (59%) compared to resident foreign buyers (27%). Canadian buyers were the most likely to pay all-cash, at 66%, while Asian Indian buyers were the least likely, at 8%. Forty percent of Chinese buyers made an all-cash purchase.

Methodology

This survey was sent to 150,000 randomly selected REALTORS®. The online survey was conducted from May 21–June 24, 2020. A total of 11,615 REALTORS® responded to the 2020 survey, of which 1,190 reported an international residential foreign buyer. NAR also conducted separate studies for the Raleigh Regional Association of REALTORS®, Mainstreet Organization of REALTORS®, Austin Board of Realtors®, the Long Island Board of Realtors® and the Ohio Realtors®, and their responses were added to the national random sample. To correct for over/under-sampling across states, NAR weighted the distribution of responses to the distribution of NAR membership by state as of June 2020. Respondents provided information about the characteristics of international clients based on the most recent closed transactions from April 2019–March 2020. To minimize the response bias that can skew upwards the share of foreign buyers to existing home sales, NAR estimates the share of non-resident (Type A) foreign buyers to existing home sales from the monthly REALTORS® Confidence Index Survey that that gathers information on the characteristics of transactions of the respondent’s most recent sale for the reference month, which are viewed as a random sample of all transactions for the month.

Source: NAR

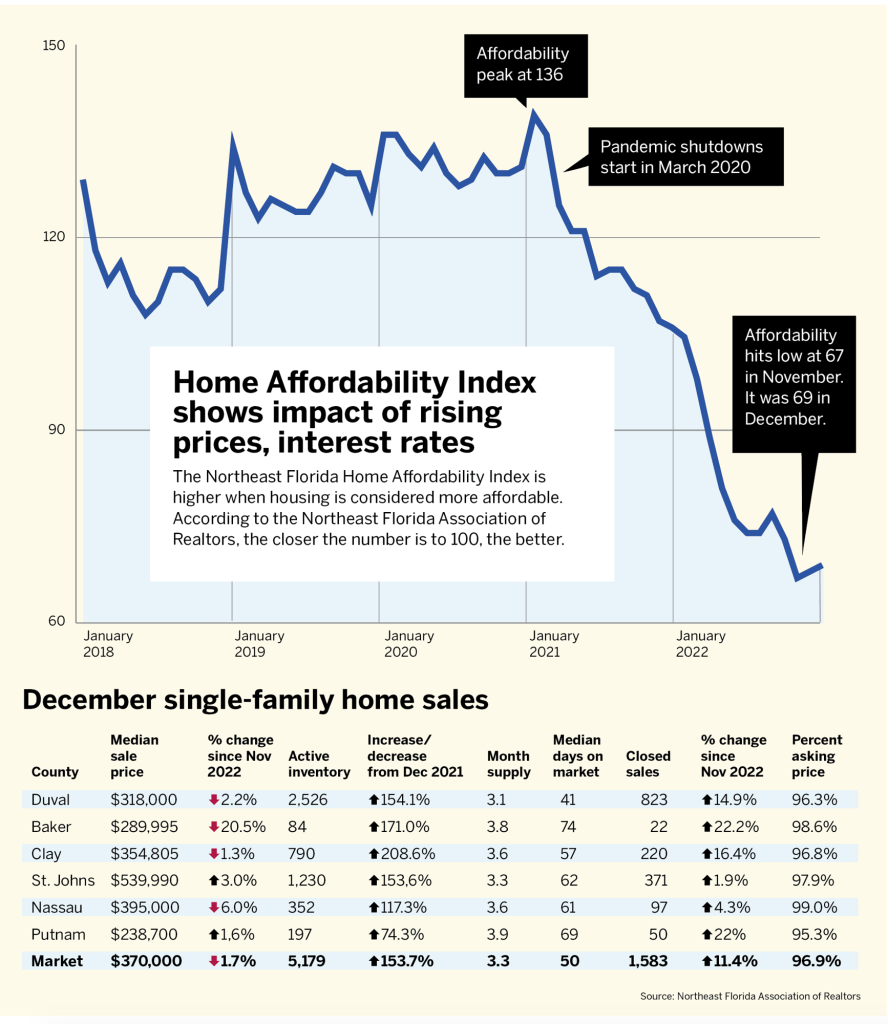

The U.S. real estate market is now doing better than it did before the pandemic, with the Recovery Index hitting 103.8 compared to a back-to-normal score of 100. Two Central Florida metros have fully recovered as South Florida and Jacksonville move closer.

The U.S. real estate market is now doing better than it did before the pandemic, with the Recovery Index hitting 103.8 compared to a back-to-normal score of 100. Two Central Florida metros have fully recovered as South Florida and Jacksonville move closer.