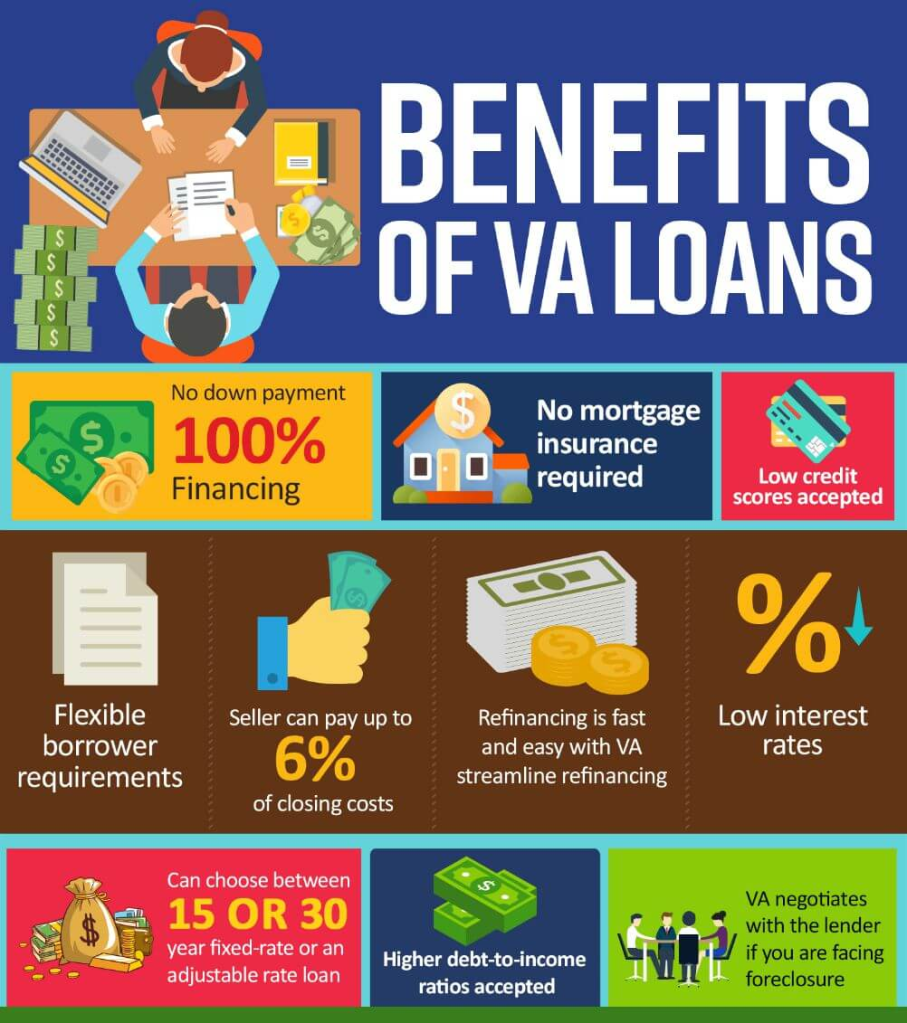

Are you or someone you know considering a VA loan for a new home? Here’s some valuable information that can help you navigate the process more smoothly and save money at the closing table.

One of the significant advantages of VA loans is that they require no down payment for qualified VA borrowers. But that’s not all! When it comes to closing costs, there’s a distinct advantage for veterans as well. Here’s a breakdown of how it works:

Types of Closing Costs

VA borrowers are limited in terms of which closing costs they can pay for, and a handy acronym to remember these allowable costs is ACTORS:

A – Appraisal

C – Credit Report

T – Title Insurance

O – Origination Fee

R – Recording Fee

S – Survey

These are the charges most commonly found on VA mortgages and can be paid for by the veteran. However, there are other charges like attorney fees, underwriting fees, escrow, processing fees, document fees, and tax service fees that veterans are not allowed to pay.

Who Pays for Non-Allowed Costs?

The Seller Can: The seller of the property can agree to pay non-allowed closing costs as part of the sales contract, commonly known as a seller concession. This is typically limited to four percent of the home’s sales price.

The Lender Can: Lenders can offer a credit to the borrower by adjusting the interest rate. This can help offset some or all of the closing costs.

The Borrower Can: Instead of non-allowed fees, the lender may charge a one percent origination fee, which is an allowable charge for VA loans.

The Agent Can: In some cases, the real estate agent representing the buyer can contribute towards closing costs. This contribution comes from the commissions paid by the seller.

It’s important to note that VA loan closing costs differ from FHA or conventional loans, and understanding who is responsible for specific fees can be confusing. If you have any questions or need clarification, don’t hesitate to reach out to your loan officer. We’re here to help you make the best financial decisions for your home purchase journey!

Ready to take the next step? Give me a call today to get started on your path to homeownership with a VA loan. Your dream home is within reach!

If you have real estate questions or interested in buying or selling a home in Northeast Florida, please contact me at (904) 307-8998 or email williamvasana@kw.com. As a local area expert in Jacksonville Florida, I offer the highest level of professional services, luxury condo savvy, extensive residential experience, and intensive knowledge about Jacksonville neighborhoods and the overall market in the pre-construction and luxury development. I specialize in residential homes, condominiums, waterfront properties and new construction homes in Duval, St. Johns and Clay counties.